About the author: Lauren Williams, CFP®, CRPC®, MBA, is the co-founder of ProsperPlan Wealth and a fiduciary wealth advisor with nearly two decades of experience. She works with families, business owners, and healthcare professionals on retirement, tax strategies, and the challenges of multi-generational wealth. Known for blending technical expertise with insights from psychology and finance, Lauren helps clients do more than manage money – she helps them design lives of freedom, purpose, and security. Having reached financial independence herself, she brings both professional depth and personal perspective, offering evidence-based strategies grounded in economics, markets, human behavior, and life experience.

U.S. Bull Market Holds Steady as ProsperPlan Rebalances Portfolios for 2025’s Final Stretch |

|

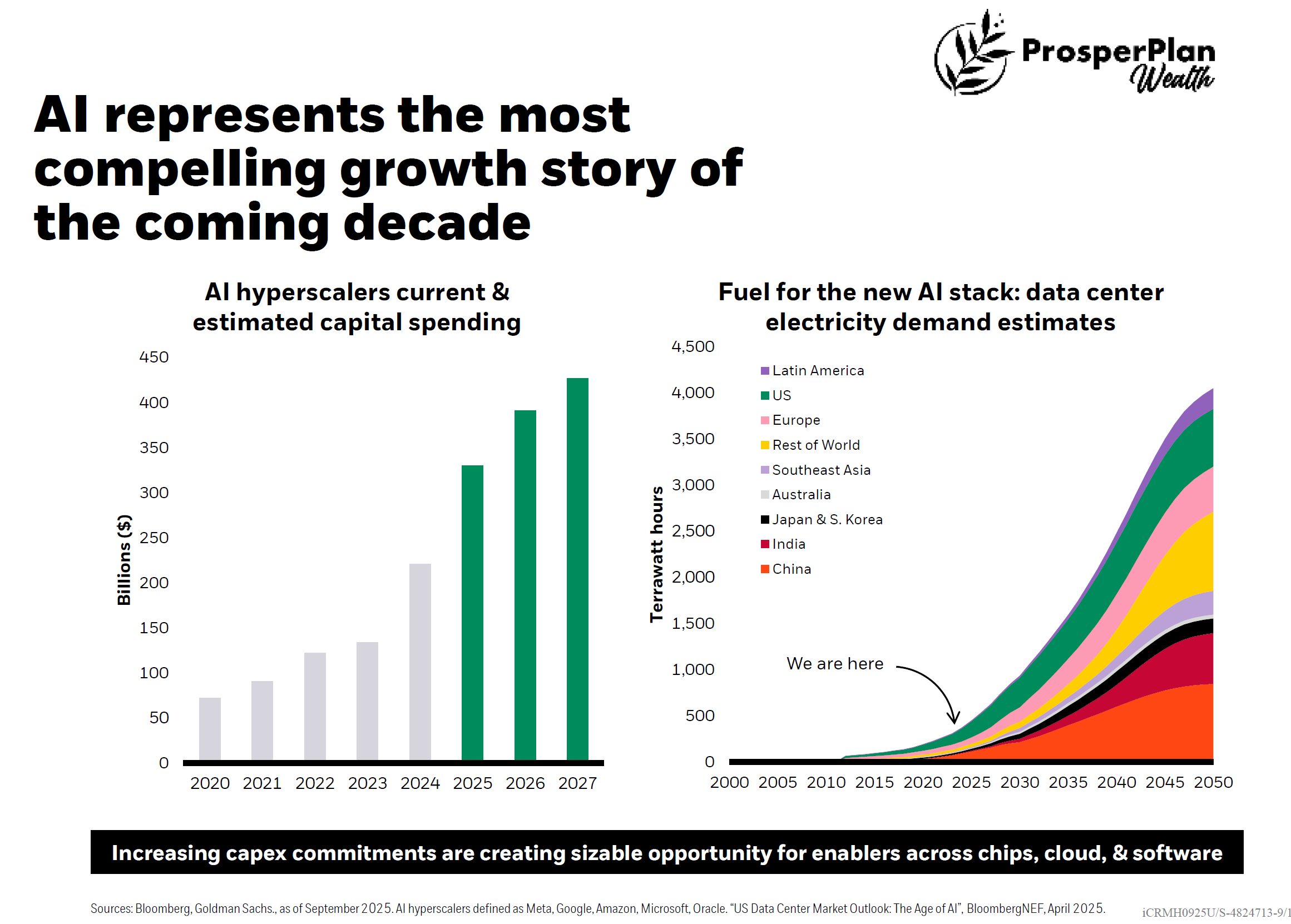

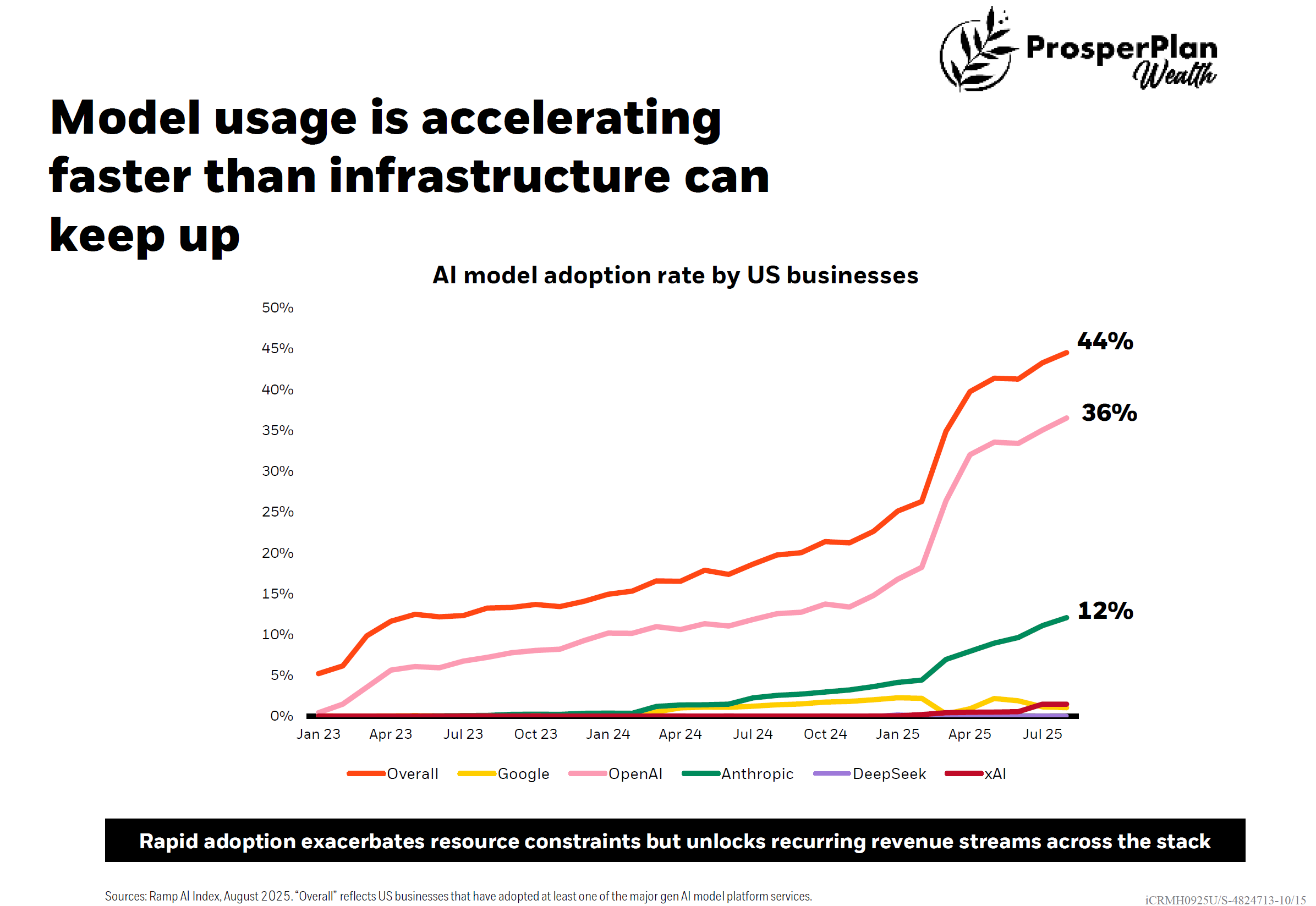

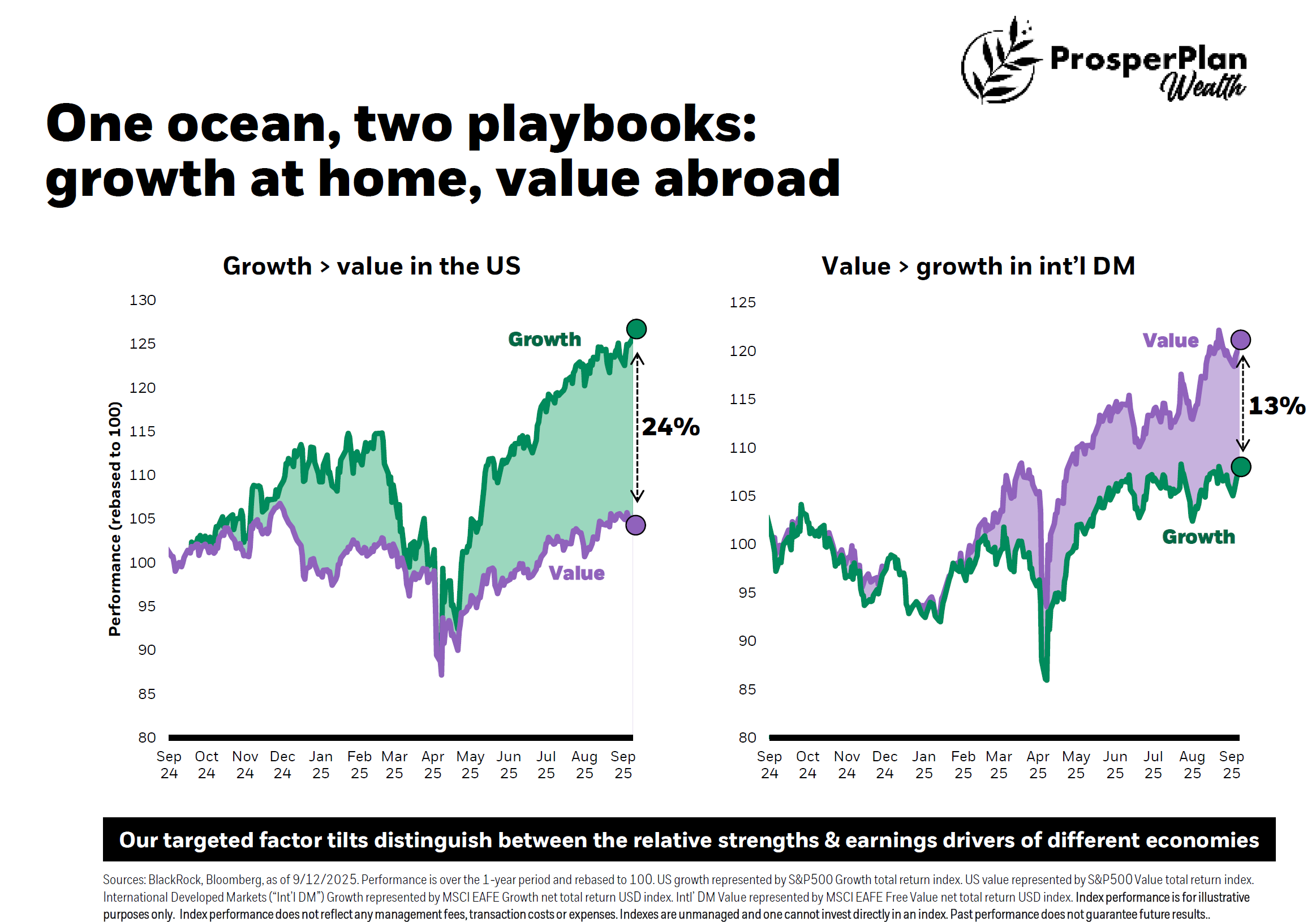

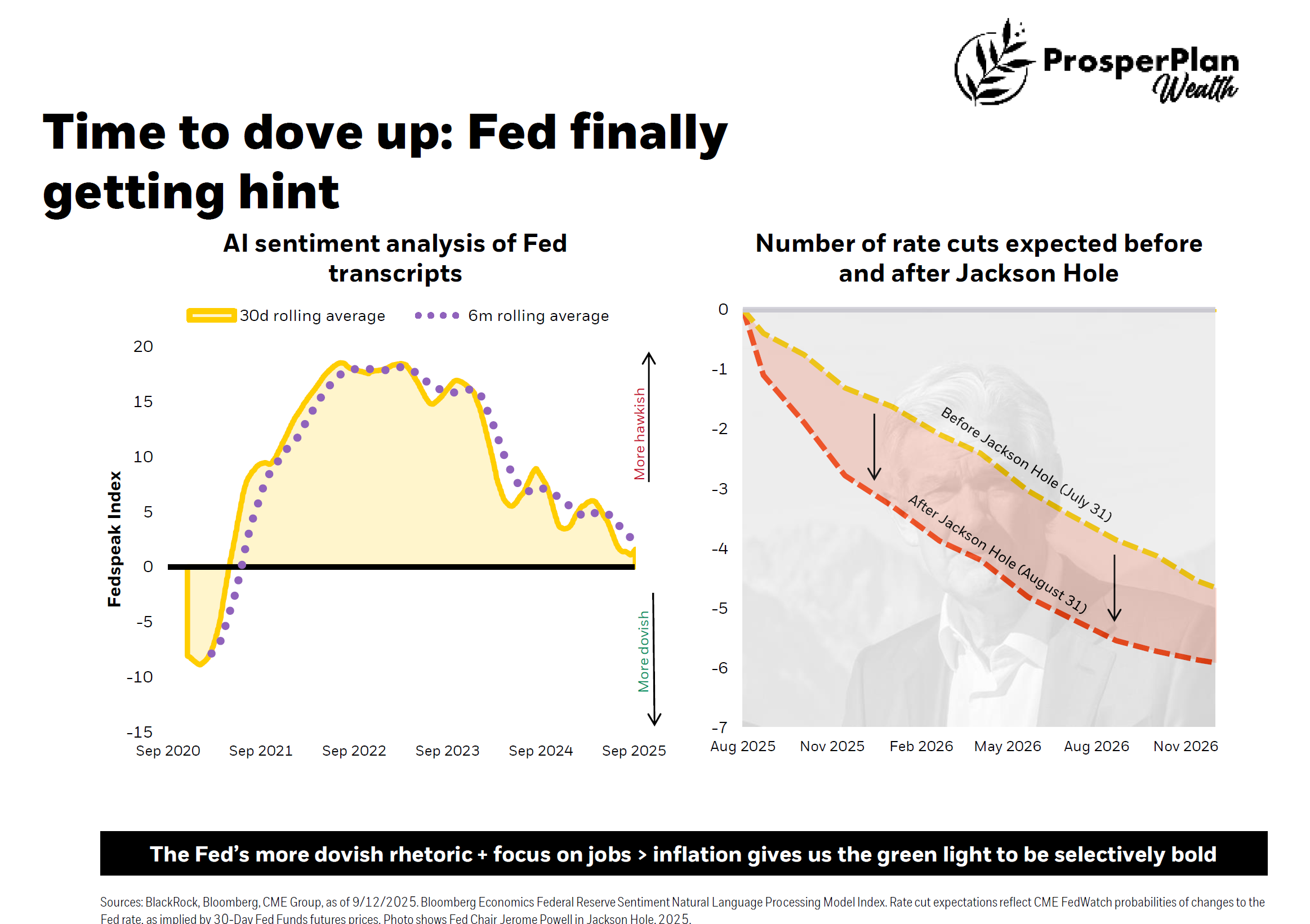

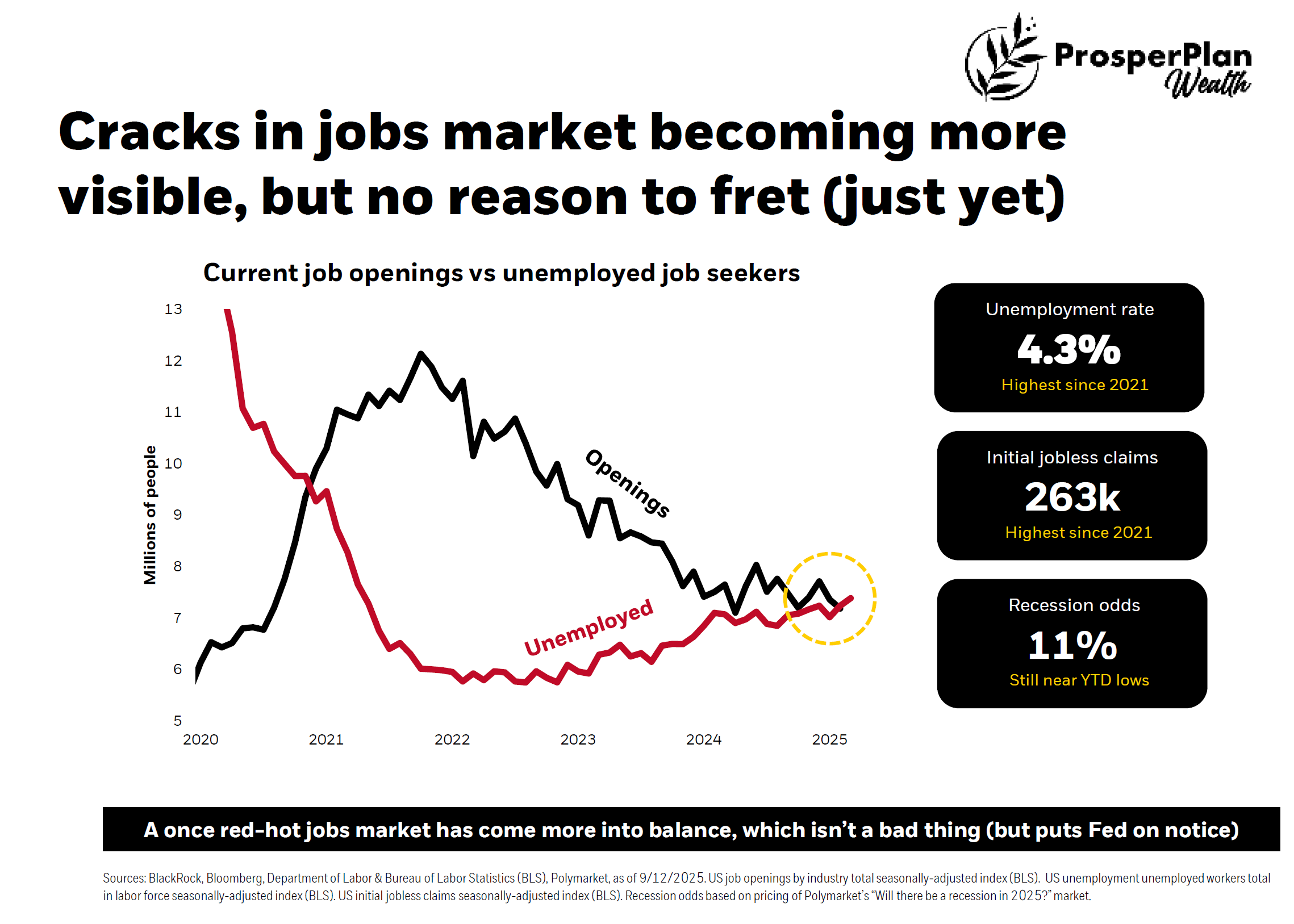

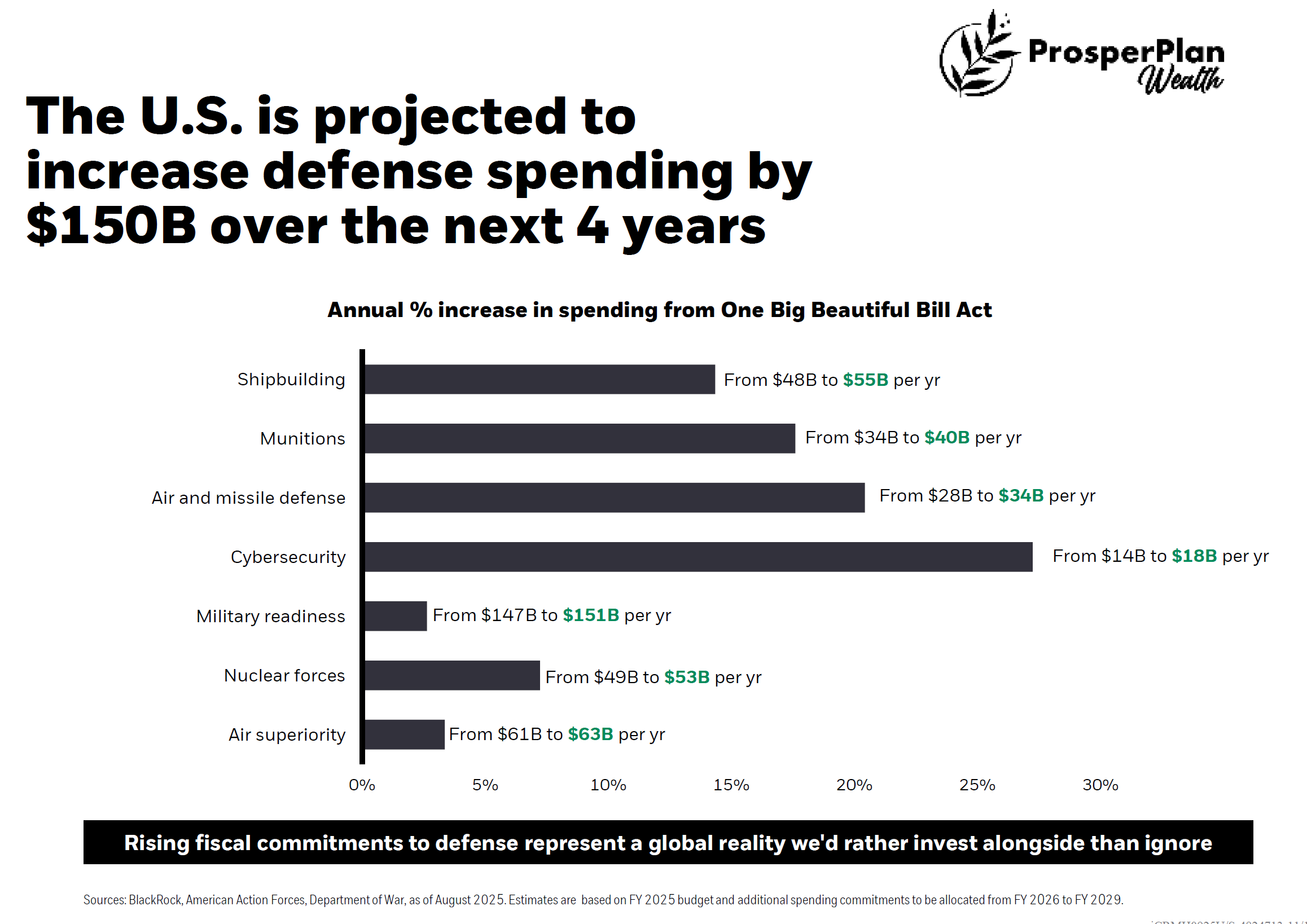

As 2025 enters its final quarter, our clients face a paradoxical picture: unsettling headlines about a cooling labor market and geopolitical tension, alongside a resilient U.S. economy and a bull market that refuses to fade. Against this backdrop, our team at ProsperPlan Wealth has executed its latest rebalance to our core portfolios, adjusting exposures to capture long-term opportunities while safeguarding you against short-term risks. This latest rebalance has clients leaning in and asking the same question: “Why now?” “We last made significant changes in May when conditions were favorable for growth,” said Chris Grellas, Co-Founder at ProsperPlan Wealth. “Now, with the Federal Reserve easing policy, and structural trends like artificial intelligence accelerating, it made sense to fine-tune our models again. The changes are small, but their impact is meaningful.” Focusing on the Mega Change: Artificial IntelligenceAt the center of our team’s latest rebalance is a slightly heavier tilt toward artificial intelligence. We call it a “Mega Change,” likening its transformative potential to the rise of the Internet in the 1990s. Currently in its infancy, major money is flowing towards the growth of this sector. More than $1 trillion has already been committed globally to AI infrastructure, with projections as high as $7 trillion by 2030 – nearly 2% of expected global GDP. While the household names of Big Tech (Microsoft, Nvidia, and Meta) dominate headlines, our team sees opportunities across the ecosystem: data centers, AI semiconductors, cybersecurity, and private-sector cloud infrastructure. Yet as technology accelerates, so do the risks. In response, our team is announcing a new initiative with NewEdge Advisors: cyber fraud insurance coverage of up to $1 million per client, aimed particularly at protecting our clients from increasingly sophisticated cybercrime. We will be sending out more information about this program as our underwriting team completes its final reviews and implementation details, ensuring every client understands how this risk mitigation insurance will be used to protect their financial well-being. Growth vs. Value: Divergent Stories at Home and AbroadU.S. growth stocks – particularly in technology – have surged ahead of their value counterparts in 2025, fueled by easing borrowing costs. Abroad, value stocks still hold sway, but our team’s strategy trims European exposure in favor of American tech-led expansion. “Our allocation continues to lean into U.S. growth, especially in technology and AI, while scaling back markets where earnings are weaker,” Grellas said. “It is important to maintain international exposure for diversification.” A Hybrid Play: Convertible Bonds as an AlternativeFor income-focused investors who still want portfolio growth, our team is including convertible bonds – particularly those tied to larger companies with ample cash flow. These hybrid securities combine the steady income of traditional bonds with the growth potential of equities (stocks), creating a balance between conservative and growth-oriented strategies. It’s worth remembering that bonds, by design, are income instruments rather than growth vehicles. In most cases, they maintain their value while paying investors regular yield. As we saw this year, however, bond prices can rise as interest rates fall – providing an additional source of return. Convertible bonds take this one step further by offering exposure to equity upside, allowing investors to capture a measure of growth potential without leaving the stability of fixed income behind. A Fed Shift: From Headwind to TailwindAfter years of aggressive tightening, the Federal Reserve delivered its first rate cut of this cycle, signaling that inflation has been tamed. Core CPI has stabilized, and the Fed’s “dot plot” now points toward a more supportive stance for both the stock market and bonds. “The Fed is no longer the enemy of growth,” our team noted. “It’s become a tailwind.” Have you ever wondered what it means when you hear financial talking heads say “headwind” or “tailwind?” (Probably not, but I’m going to tell you anyway.) A headwind is like flying into the wind – it slows down market growth, just like high interest rates or peak inflation. A tailwind pushes the market forward – think advantages like lower borrowing costs, more cash available for lending and spending, or strong consumer demand. Simply, tailwinds are favorable conditions for pushing your portfolio to new heights. Labor Market: Signs of Shifting Supply and DemandThe U.S. labor market is showing signs of fatigue, and ProsperPlan Wealth’s Sean D. Harvey says the slowdown is likely to continue in the months ahead. Harvey emphasized that while this isn’t a collapse, it is a clear cooling trend. “The labor market is normalizing, but it’s also weakening. We expect more softness as we move into 2026, with job mobility declining and opportunities harder to come by, but we also anticipate less people choosing to quit their current jobs.” For investors, his advice is to stay disciplined. “The Fed will likely keep easing to support growth, but that shouldn’t be mistaken for a quick fix. If you’re employed, use this period to strengthen your cash reserves and prepare for potential job transitions. Building that cushion is one of the best hedges against uncertainty.” Economic Outlook: Stronger Than ExpectedThe U.S. economy continues to outperform expectations. Second-quarter GDP was revised upward to 3.2%, and the probability of recession has fallen to just 11% – below historical averages. Looking ahead, the fiscal year 2026 federal budget is set to prioritize infrastructure and defense. Funding from the Bipartisan Infrastructure Law remains in place through 2026, channeling billions into transportation, broadband, and clean energy projects. At the same time, the Department of Defense has requested nearly $962 billion, a sharp increase from prior years. Together, these spending priorities are expected to funnel significant capital toward U.S. construction, energy, and defense companies, bolstering earnings growth in those important economic sectors that support infrastructure. The Bottom LineThe latest rebalance of our GuidePath Core Asset Allocation is less about reacting to headlines than preparing for the environment ahead. Our team is:

Markets change. Strategies evolve. But our mission remains constant: protecting your financial security while growing your wealth. For clients, the takeaway is clear: your portfolio remains aligned with your goals while staying positioned to capture new opportunities. The headlines and noise of 2025 don’t change the bigger story – fundamentals are strong, and with discipline, families can continue building the retirement lifestyle they’ve worked so hard for. At the end of the day, that is why we exist – we want you to be successful, educated, and an unshakable investor.

1 Bloomberg, Goldman Sach, as of September 2025. US Data Center Outlook: The Age of AI. 2 Ramp AI Index, August 2025. “Overall” reflects US businesses that have adopted at least of the major AI model platform services. 3 BlackRock, Bloomberg, Department of Labor & Bureau of Labor Statistics (BLS) as of 9/12/2025 4 BlackRock, American Action Forces, Department of War, as of August 2025. Your Team at ProsperPlan Wealth, Lauren M. Williams, CFP®, CRPC®, MBA |